What are diluted shares?

Diluted shares reflect the potential number of shares a company could have if all convertible securities — such as stock options, warrants, or convertible bonds — were converted into common shares.

Share dilution occurs when new shares are issued, or when existing rights to shares (such as employee stock options) are exercised. As a result, the ownership percentage of current shareholders is reduced, which can affect their control of the company and the value of their holdings.

Understanding diluted shares is crucial when managing equity compensation programs, structuring stock options, and assessing their overall impact on company ownership and financial performance.

How does share dilution occur?

As mentioned, share dilution typically occurs when a company issues new shares, or when existing convertible securities are exercised. Common scenarios include:

Stock options. Employees often receive stock options as part of their compensation. When they exercise these options and convert them into shares, the total number of outstanding shares increases, leading to dilution.

Warrants. Warrants are similar to options, granting holders the right to purchase shares at a specified price. When warrants are exercised, the company must issue new shares, diluting the existing shareholder base.

Convertible bonds. These are bonds that can be converted into a set number of shares. If bondholders convert their bonds into stock, the company’s share count increases, diluting existing shareholders.

Equity grants or restricted stock units (RSUs). RSUs and equity grants also contribute to diluted shares when they vest and convert into common stock.

What happens when shares get diluted?

Diluted shares can impact businesses in several ways, such as:

Investor confidence. Dilution can influence investor sentiment, as issuing too many new shares can dilute their value and make the company’s stock less attractive. Investors often assess both basic and diluted shares when making investment decisions.

Equity compensation. Diluted shares affect how equity-based compensation (such as stock options or RSUs) is structured. Offering too much equity can result in significant dilution, reducing the value of shares for all shareholders (including employees).

Impact on ownership. As new shares are issued or converted, existing shareholders’ ownership percentages decrease. This means that current shareholders may lose some control over the company’s decision-making processes or overall value.

Example of diluted shares

A company has 1 million shares outstanding and employees hold stock options that, if exercised, would convert into 200,000 additional shares. If all stock options are exercised, the total number of shares would increase to 1.2 million (1 million + 200,000).

In this case, the ownership percentage of existing shareholders would decrease accordingly. For example, a shareholder owning 100,000 shares in the original 1 million-share company would previously have held 10% ownership (1 million / 100,000).

However, after dilution, their ownership percentage would drop to 8.33% (1.2 million / 100,000).

Managing share dilution

To mitigate the impact of diluted shares, businesses should set dilution limits by carefully managing stock option pools and considering the long-term impact of convertible securities.

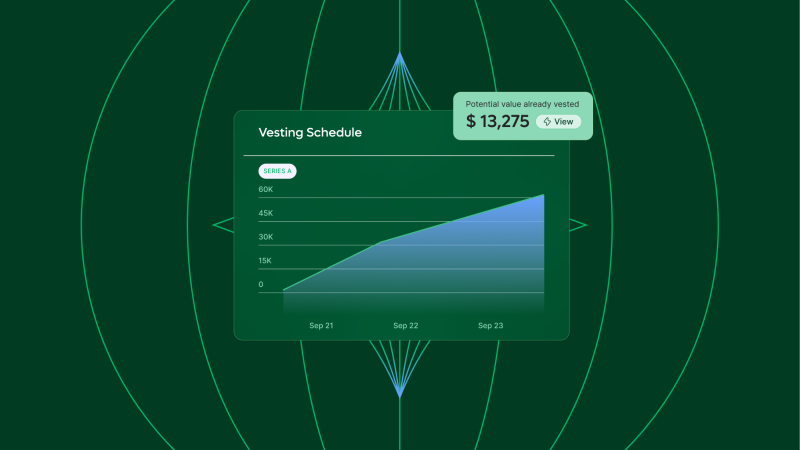

Offering equity compensation with appropriate vesting schedules can also mitigate the immediate impact of dilution, and help ensure employees contribute to the company’s success over time.

Trending terms

WFH stipend

Transform spaces, elevate workplaces

Boomerang Employee

Old legends, new triumphs

Fringe Benefits

Upgrading the daily grind

Absence management

Balancing work and well-being

Disregarded entity

Simplified structure, full control

Inputed income

Quietly counted compensation

Nepotism

Competence, not cousins

Upward mobility

Scaling heights, sans vertigo