What are advisory shares?

Advisory shares are stock options or shares given to advisors for providing expert advice or assisting in the company's growth.

Rather than paying advisors with cash, companies — especially startups — use this approach to attract high-level talent, motivate long-term involvement, and conserve budget.

These shares usually come with certain conditions (such as vesting schedules and performance metrics) to ensure that the advisor continues contributing to the company’s success over time.

Are advisory shares for employees?

No. Advisors are typically external experts or board members who provide advice on areas such as strategy, fundraising, marketing, or operations.

How do advisory shares work?

Advisory shares are usually granted under the following conditions:

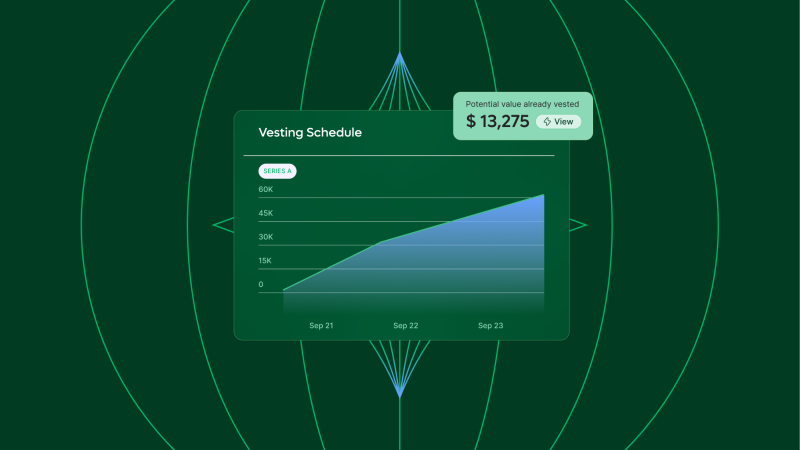

A vesting schedule. Advisors receive their shares over time, usually based on a vesting schedule that could last 2–4 years. This ensures the advisor remains committed to the company.

An advisory agreement. An advisory agreement outlines the terms of the engagement, including how many shares the advisor will receive, the vesting schedule, and the advisor's expected contributions.

Stock options or equity grants. Depending on the company, advisory shares may be granted as stock options (giving the advisor the right to purchase shares at a set price in the future), or as direct equity grants (providing ownership of shares).

To ensure the advisor is contributing meaningfully, companies may apply performance metrics or specific deliverables to the vesting of advisory shares.

Example of advisory shares

A startup with a limited budget offers an experienced marketing executive 10,000 advisory shares with a 3-year vesting schedule. In exchange, the executive will provide their guidance and expertise, and help the company refine its marketing strategy and attract more customers.

Over the next three years, the advisor gradually vests into ownership of these shares, and benefits from the increase in the company’s value as it grows.

Trending terms

WFH stipend

Transform spaces, elevate workplaces

Boomerang Employee

Old legends, new triumphs

Fringe Benefits

Upgrading the daily grind

Absence management

Balancing work and well-being

Disregarded entity

Simplified structure, full control

Inputed income

Quietly counted compensation

Nepotism

Competence, not cousins

Upward mobility

Scaling heights, sans vertigo