Global businesses reward with Remote

Grant equity faster, everywhere

Eliminate the long process of granting equity to global employees. Do in seconds what takes most companies weeks.

Keep employees informed

Tools for your team to stay up to date with what their equity means for them — and how to use it.

Make smarter equity decisions

Get all the insights you need to understand who has equity and how much, where vesting schedules stand, and more.

Remote Equity in action

Manage and grant equity internationally with a single tool

Grant equity faster, everywhere

Issue equity to employees across the world in a few clicks. Spend less on legal fees, save time, and ensure team members are eligible for your plan.

Faster equity

Build equity grants specific to your employees in every country. Just enter the information, then get your documents.

Future-proof equity planning

Build an equity plan that scales with your business. Decide who should get what and when, then execute when the timing is right.

Smoother board operations

Your board can approve new equity grants right in the app, anytime. No more waiting for the next meeting or marathon consent sessions.

Keep employees informed

Worried about tax treatment and withholding in different countries? Remote’s equity experts provide you (and your team) with detailed, country-specific guidance at your fingertips.

Country-specific breakdowns

Learn what you need to know on a local level with the easy-to-digest legal and tax information you need to take action.

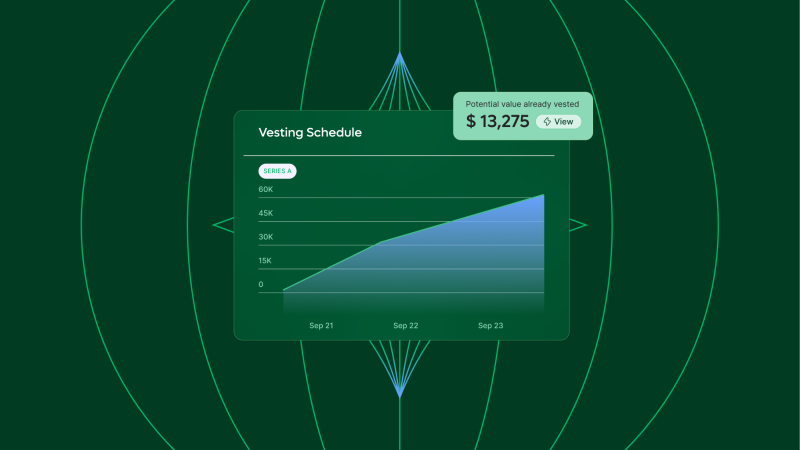

Real-time evolution

Show team members exactly what equity they’re getting and what it means for their wallet with always up-to-date equity and vesting information.

Reward employees with ownership

Make equity a real incentive by helping your team see the true value in the equity you grant them.

Make smarter equity decisions

Determine who should get what and when, then execute when the timing is right. Your board can approve new equity grants quickly, even between meetings, and employees can check the status of their equity at any time.

Always-current legal compliance

Stay informed with the latest updates on global equity and taxation laws.

In-depth analysis

Access a wealth of data on your employee stock option plan to understand the impact it has on your team

Around-the-globe support

Get answers to the most complex of questions with clarity and speed.

Always fair pricing

We don’t like hidden fees and third-party add-ons. So we don’t charge any. Our flat-rate pricing plans let you predict your bill with pinpoint accuracy every time.

Equity

Equity compensation for your global workforce with fully compliant stock option grants in 75+ countries

Starting at USD 999/year

Top features

Fully compliant equity for your global team

Instantly synced with your cap table

Transparent, trustworthy equity processes

Tax handling and reporting obligation assistance

Deep insights into your equity program

Simple equity knowledge accessible on-demand

Expert resources at your fingertips

BlogGlobal Employment & Expansion

BlogGlobal Employment & ExpansionMaking equity easy: Remote and Carta join forces to create Remote Equity

BlogBenefits & Leave

BlogBenefits & LeaveStartup equity guide: How to add incentives to your global benefits package

BlogNewsroom

BlogNewsroomRemote welcomes Easop to demystify global equity management

BlogTax and Compliance

BlogTax and ComplianceHow to manage your equity incentives with Remote

BlogBenefits & Leave

BlogBenefits & LeaveHow to offer stock options to foreign employees

Frequently Asked Questions

An Employee Stock Ownership Plan (ESOP) is a program that provides employees with ownership interest in the company, typically through the distribution of stock options. It’s a tool used by businesses to motivate employees, align interests with company performance, and offer a financial benefit tied to the company's success.

To grant stock options to international employees, you need to consider local employment laws, tax regulations, and currency exchange factors in each country where the employee is based. Partnering with a global payroll and compliance provider like Remote can help ensure you're meeting local legal requirements while administering the ESOP

The tax implications of stock options for international employees vary by country. Some nations may tax stock options when they are granted, vested, or exercised, while others may impose taxes only when shares are sold. It's crucial to consult local tax advisors to navigate the complexities of international taxation.

Yes, international employees can participate in an ESOP, but the structure and execution may differ depending on local regulations and employment laws. Some countries have specific rules regarding employee ownership, so it's important to adjust the plan accordingly for compliance.

Managing an ESOP for international employees can be complex due to varying regulations, tax laws, and administrative challenges across different countries. Ensuring compliance with local laws, providing accurate financial reporting, and handling currency differences are some of the key challenges. Working with an experienced global partner can streamline the process.