Global companies grow with Remote

Contractor Management trusted by global teams

Powerful automation tools on a centralised platform

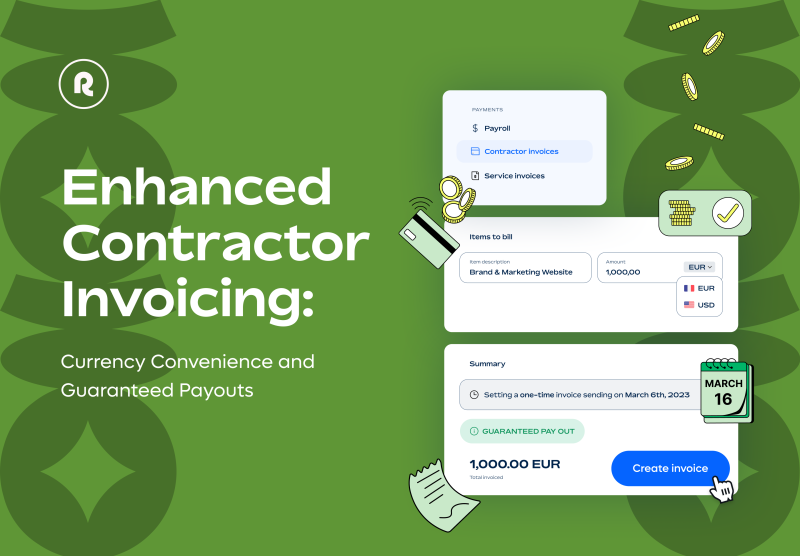

Spend less time managing invoices and making payments so you can spend more time building your business and less time on contractor management outsourcing.

Maximise value while minimising costs

Easily manage contractors everywhere at a flat-rate price on a contractor management system that automatically detects which contractors are active to keep your bill low.

Protect against misclassification risk while you scale

Protect your company from contractor compliance risk with built-in misclassification and tax tools.

Remote Contractor Management in action

Scale and manage your global contractor workforce with ease.

Powerful automation tools on a centralised platform

Our platform simplifies contractor management by integrating advanced automation features for onboarding, invoicing, and global payments. With everything centralised, you can efficiently handle all contractor-related tasks, providing quick onboarding, flexible payment options, and secure transactions in local currencies worldwide.

Fast and reliable global payments

Pay international contractors in their local currencies all around the world.

Maximise value while minimising costs

Achieve significant cost savings with our contractor management system designed to minimise expenses while maximising efficiency. Benefit from automatic detection of active contractors to avoid unnecessary charges, reduced compliance costs across multiple countries, and a unified platform that manages all your contractor needs effectively.

Protect against misclassification risk while you scale

Protect your business from misclassification risks with our comprehensive contractor management solutions. Our platform provides compliance with regional regulations through localised contracts, offers enhanced security with indemnity coverage, and keeps you informed about labour law changes globally, enabling safe and scalable business growth.

Integrations make Remote even better

We play well with others. Connect Remote to some of the world’s top names in HR and see how good life can be when all your tools work together.

Always fair pricing

We don’t like hidden fees and third-party add-ons. So we don’t charge any. Our contractor management software automatically keeps your bill as low as possible every month setting us apart from other contractor management outsourcing options.

Contractor Management

Compliantly onboard and pay contractors

£23

per contractor/month

Top features

Only pay for contractors you actively work with

Work with contractors in 200+ countries

Create, edit, and sign tailored, localised contracts

Approve contractor invoices with one click or auto-pay

Transparent payments with complete visibility

Expert insights, just one click away

BlogContractor Management

BlogContractor ManagementA guide to self-employed retirement accounts

BlogContractor Management

BlogContractor ManagementFreelance invoice software: Benefits, features, and which should you choose?

BlogContractor Management

BlogContractor ManagementContractor management software: Build or buy?

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Massachusetts: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in New York: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementAutomating contractor management for the professional services world

BlogContractor Management

BlogContractor ManagementCommon contractor management mistakes and how to avoid them

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in New Jersey: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementContractor rights and obligations: what you need to know

BlogContractor Management

BlogContractor ManagementHow to pay international contractors

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Texas: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Ohio: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementHow to assess independent contractor payroll solutions

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Virginia: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Pennsylvania: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementTop 5 benefits of using contractor management software

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Florida: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Michigan: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Georgia: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes in Wisconsin: freelancer tax management guide

BlogContractor Management

BlogContractor ManagementWhich job functions are best to outsource to international contractors?

BlogContractor Management

BlogContractor ManagementHow to offer benefits for 1099 and international independent contractors

BlogContractor Management

BlogContractor ManagementHow to onboard independent contractors: an expert guide

BlogContractor Management

BlogContractor ManagementGig worker vs. independent contractor: which one is right for your business?

BlogContractor Management

BlogContractor ManagementHow to manage independent contractor payroll

BlogContractor Management

BlogContractor ManagementWhat is an independent contractor?

BlogContractor Management

BlogContractor ManagementWhen should you convert a contractor to an employee?

BlogContractor Management

BlogContractor ManagementA guide to freelancing and working abroad

BlogContractor Management

BlogContractor ManagementHiring independent contractors: pros, cons and the ideal process

BlogContractor Management

BlogContractor ManagementThe consequences of misclassifying employees as contractors

BlogContractor Management

BlogContractor ManagementHow to pay independent contractors: the expert guide

BlogContractor Management

BlogContractor ManagementEmployee and independent contractor misclassification: Expert guide

BlogContractor Management

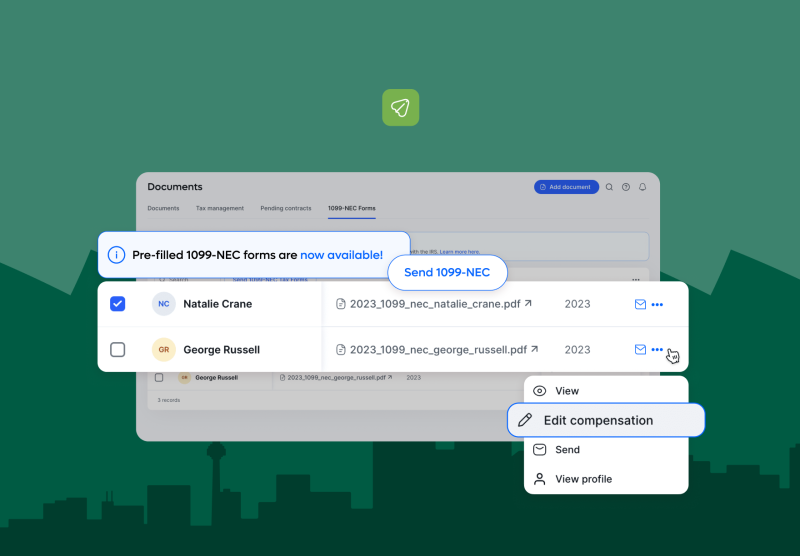

BlogContractor ManagementRemote Contractor Management: Tax compliance for US companies just got easier

BlogContractor Management

BlogContractor ManagementHow to assess independent contractor management software

BlogContractor Management

BlogContractor ManagementIndependent contractor vs. employee: which should you hire?

BlogContractor Management

BlogContractor ManagementHow to offer stock options to independent contractors

BlogContractor Management

BlogContractor ManagementHow to manage independent contractors: an expert guide

BlogContractor Management

BlogContractor ManagementThe future of gig economy and its impact on work

BlogContractor Management

BlogContractor ManagementWhat are the risks of converting employees to contractors?

BlogContractor Management

BlogContractor ManagementHow to become an independent contractor in 6 simple steps

BlogContractor Management

BlogContractor ManagementForm 1096: Who is it for and how do you file it?

BlogContractor Management

BlogContractor ManagementA complete guide to NDAs for contractors and remote workers

BlogContractor Management

BlogContractor ManagementHow to hire and pay independent contractors in the UAE

BlogContractor Management

BlogContractor ManagementFreelance business license: Do you need one?

BlogContractor Management

BlogContractor ManagementHow to hire and pay independent contractors in Saudi Arabia

BlogContractor Management

BlogContractor ManagementHow to hire and pay independent contractors in New Zealand

BlogContractor Management

BlogContractor ManagementHow to hire and pay independent contractors in South Korea

BlogContractor Management

BlogContractor ManagementHow to hire and pay independent contractors in Ireland

BlogContractor Management

BlogContractor ManagementThe best freelance management systems to manage global freelancers

BlogContractor Management

BlogContractor ManagementWhat is a non-solicitation agreement for independent contractors?

BlogContractor Management

BlogContractor ManagementYour guide to self-employed tax deductions in the UK

BlogContractor Management

BlogContractor ManagementHow to invoice as a freelancer: a simple guide and a free invoice template

BlogContractor Management

BlogContractor ManagementA guide to independent contractor bonus payments

BlogContractor Management

BlogContractor ManagementHow to nail contractor invoicing: top tips to get paid faster

BlogContractor Management

BlogContractor ManagementBest contract management software for freelancers

BlogContractor Management

BlogContractor ManagementAchieving contractor management compliance: best practices

BlogContractor Management

BlogContractor ManagementW-9 vs. 1099 tax forms: A plain-language guide

BlogContractor Management

BlogContractor ManagementHow to get paid as a freelancer

BlogContractor Management

BlogContractor ManagementHow to hire and pay independent contractors in Malta

BlogContractor Management

BlogContractor ManagementHow to hire freelancers as part of your business strategy

BlogContractor Management

BlogContractor ManagementA guide to liability insurance for contractors

BlogContractor Management

BlogContractor ManagementYour guide to independent contractor tax deductions

BlogContractor Management

BlogContractor ManagementContractor management: Benefit from invoicing automation with Remote

BlogContractor Management

BlogContractor ManagementSafeguard your business with Remote Contractor Management Plus

BlogContractor Management

BlogContractor ManagementThe handbook for independent contractor insurance

BlogContractor Management

BlogContractor ManagementWhat is an umbrella company?

BlogContractor Management

BlogContractor ManagementIndependent contractor taxes: a guide for businesses

BlogContractor Management

BlogContractor ManagementIndependent contractor agreements: a guide for businesses

BlogContractor Management

BlogContractor ManagementGlobal flexible teams: The way of the future

BlogContractor Management

BlogContractor ManagementBorderless payments for contractors with flexible currency options

BlogContractor Management

BlogContractor ManagementWhat is a 1099 form? A guide for companies with US contractors

BlogContractor Management

BlogContractor ManagementRemote’s Global Freelancer Report: the state of play in 2023

BlogContractor Management

BlogContractor ManagementGuide to freelancing jobs for veterans

BlogContractor Management

BlogContractor ManagementAutomated contractor payments on Remote

BlogContractor Management

BlogContractor ManagementHiring independent contractors abroad: your expert guide

BlogContractor Management

BlogContractor ManagementFast, flexible, and simple contractor management with Remote

BlogContractor Management

BlogContractor ManagementWhat is a W-8 BEN form? A guide for US employers

Frequently asked questions

You can get started with Remote Contractor Management for free! Enjoy a 30-day trial to onboard and manage contractors without any charges.

After the trial, if your contractors engage in billable activities like invoicing, contract signing, or receiving payment for pending invoices, the cost is $29 per contractor per month. Credit card payments carry a 3.5% service fee, but rest assured, no hidden fees or surprises. Find out more about Remote Contractor Management and our Fair Price Guarantee on our blog.

Businesses can pay contractor invoices by wire transfer, ACH, SEPA, or credit card. Contractors receive payments directly in their designated bank accounts via Stripe Connect.

Contractors can receive payments in the same currency for free. However, our payment partner may charge a 1-2% fee for currency conversions. There are no additional fees for receiving payments as a contractor through Remote, and we do not add any service or handling fees.

Yes, you can. You can also choose to use our contract templates and guides to ensure full compliance with local labour laws.

While Remote does not provide legal advice, we do offer localised contractor agreements and a detailed statement of work to help you and your contractors comply with local labour laws and regulations. Additionally, Remote provides an extra layer of protection against misclassification risks through our Contractor Management Plus service. This add-on not only ensures compliance for contractors but also offers indemnity coverage in case of misclassification. Learn more about Contractor Management Plus.

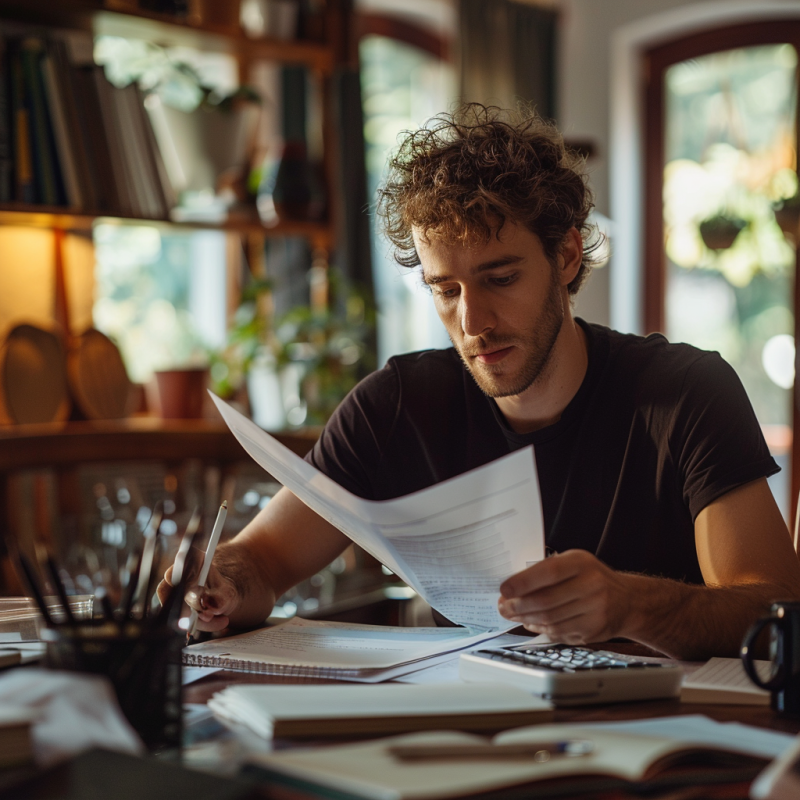

Working with an independent contractor management service like Remote allows you to eliminate repetitive administrative tasks, reduce the risk of human error, and focus on the most critical aspects of your strategy.

Managing payroll for contractors is an essential feature to expect from service providers, but it’s just one of many features to consider. Localised contract templates, facilitation of international payments, and handling tax withholdings and payments in multiple countries are equally important.

It might seem overwhelming, but working with a trusted service provider like Remote simplifies the process and reduces risks. This frees up a lot of time for you to focus on your business instead of becoming an expert on labour regulations and tax laws across multiple countries.

Not all solutions are created equal, so it's important to learn about the key features of independent contractor management and payroll services. Contracts that comply with local labour laws and facilitating faster, easier global payments are just the beginning.

Access to expert advice and support helps you make critical operational decisions swiftly. With Remote’s guidance, you can understand the intricacies of onboarding contractors in over 170 countries and access on-demand visa and immigration support.

Making payments to contractors can drain your team’s resources, especially when you’re paying international contractors. Each new contract adds to your workload. Staying compliant with relevant international laws is nearly impossible for teams focused on rapid growth.

Paying independent contractors requires an accurate and scalable system even before you onboard your first candidate. This includes ensuring contracts are compliant with labour and tax laws in each country where your contractors work. For instance, in the United States, you must also collect and automatically generate the appropriate tax forms for your contractors.

If you employ contractors in multiple countries, you need a simple way to pay invoices in various currencies without hefty bank fees or conversion costs. Automating payments will future-proof your process, particularly if you're in a growth phase and hiring quickly. Automation also introduces time-saving efficiencies when managing invoices with different payment terms.

We're happy to have you! Whether you're already a Remote customer or new to our platform, you can easily onboard, offboard, and manage independent contractors worldwide. Remote simplifies the process of paying your contractors in their preferred currencies, managing invoices, automating payments, and keeping track of essential documentation. You only pay for active contractors on Remote, so if you stop working with a contractor for a few months, you don't need to do anything to save money. Remote automatically detects if your contractors are active and only charges you when you use our services. For more information, see the Remote Fair Price Guarantee.